New Double Tax Treaty between Cyprus and Egypt – Details

According to the capital gains provisions of the treaty, the country of residence of the seller has the exclusive right to tax gains arising from the disposals of shares, except…

Double Tax Treaty between Cyprus and Greece – Dividend Confirmation

The Cyprus Tax Department recently issued a Circular announcing the release of a confirmation which should be used whenever dividends are paid from a Cyprus company to Greek tax residents. ..

Protocol to Double Tax Treaty between Cyprus and Ukraine enters in to force

On 30 October 2019 the Parliament of Ukraine approved the ratification of the protocol amending the Double Tax Treaty between Cyprus and Ukraine…

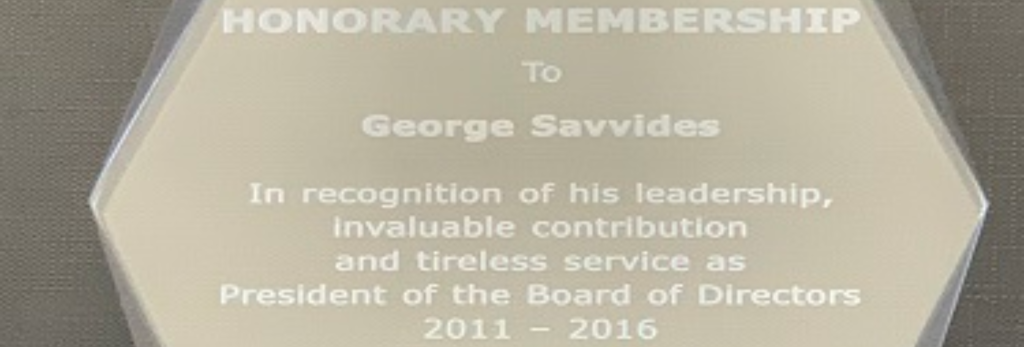

Seamark Managing Director awarded Honorary Membership of Cyprus Fiduciary Association

During an event organised by the Cyprus Fiduciary Association in the evening of 4 December 2019, George Savvides – Seamark Manging Director…

Holidays are Coming!

As we are approaching the festive season we would like to inform everyone that our office will remain closed for holidays from 24 December 2019 to 2 January 2020, both inclusive.

Merry Christmas and a Healthy, Happy and Prosperous New Year to everyone!

New/Revised Fines by Cyprus Registrar of Companies – Extension of Deadline

As we have reported back in September, as from 18 December 2019, the Registrar of Companies was supposed to start imposing an administrative fine…

Cyprus Tonnage Tax System Extended

On 16 December 2019, the European Commission approved the extension of the Tonnage Tax system applicable to the shipping industry in Cyprus for 10 years…

Public Interest Rate for 2020

With a decree issued on 20 December 2019, the Minister of Finance of the Republic of Cyprus has set the public interest rate for 2020 at 1.75%…

Cyprus and Egypt sign a new Double Tax Treaty

Cyprus and Egypt signed on 8 October 2019 a new Double Tax Treaty, aiming to replace the existing treaty, which is in force since March 1995…

Setting Up a Head Office or Regional Office

The place where an international group should base its head office or a regional office is becoming ever more critical, considering…